Vestwell Updates

Recent Posts

Vestwell and Gusto Partnership Adds New 360° API-Based Integration

Vestwell and Gusto Partnership Adds New 360° API-Based Integration Taking Vestwell’s Sales Distribution Nationwide: Meet Josh Forstater, National Sales Manager

Taking Vestwell’s Sales Distribution Nationwide: Meet Josh Forstater, National Sales Manager Closing the Gender Gap in Retirement Savings

Closing the Gender Gap in Retirement Savings RBC Clearing & Custody Selects Vestwell as Exclusive Small Plan Retirement Provider

RBC Clearing & Custody Selects Vestwell as Exclusive Small Plan Retirement Provider Closing the Racial Retirement Gap

Closing the Racial Retirement Gap High-Performance Leadership in Fintech: Meet Patty Kim, Vestwell’s Head of People

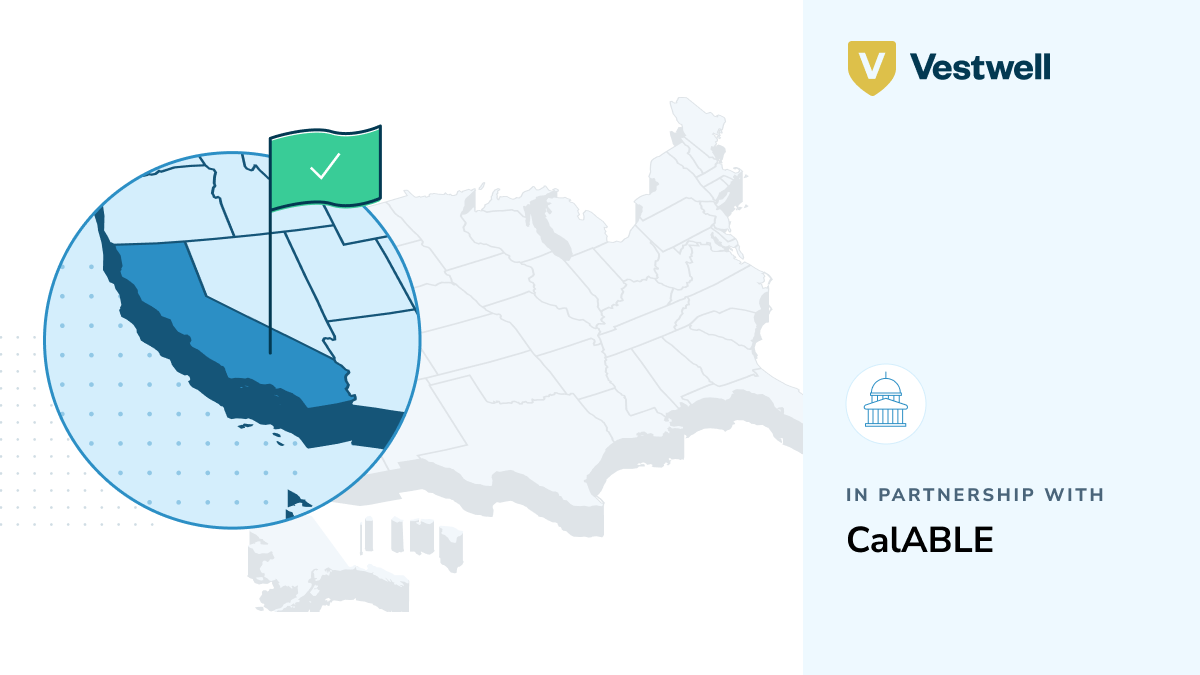

High-Performance Leadership in Fintech: Meet Patty Kim, Vestwell’s Head of People California ABLE Program Selects Vestwell to Rapidly Expand Disability Savings

California ABLE Program Selects Vestwell to Rapidly Expand Disability Savings Retirement, Business Development, & Peloton: Meet Scott Vensor, Vestwell's VP Regional Sales Director

Retirement, Business Development, & Peloton: Meet Scott Vensor, Vestwell's VP Regional Sales Director Vestwell Joins Forces with Carson Group to Launch Carson Complete 401(k)

Vestwell Joins Forces with Carson Group to Launch Carson Complete 401(k) ABLE Savings & Ice Baths: Meet Mary Rubenis, Vestwell's VP of Client Relationships

ABLE Savings & Ice Baths: Meet Mary Rubenis, Vestwell's VP of Client Relationships Vestwell Rolls Out Recordkeeping Platform Enhancements, Leapfrogging Legacy Players

Vestwell Rolls Out Recordkeeping Platform Enhancements, Leapfrogging Legacy Players Triathlons, Retirement, & More: Meet Kevin Gaston, Vestwell's Director of Plan Design

Triathlons, Retirement, & More: Meet Kevin Gaston, Vestwell's Director of Plan Design